Is a company incorporated in Malaysia or a trustee of a trust or body of persons registered under any written law in Malaysia. Budget 2019 RPGT Change increased from 5 to 10 for companies and foreigners selling after five years.

Taxation On Property Gain 2021 In Malaysia

Can result in transfer of costs from seller to buyer with adjusted house prices.

. A chargeable gain is a profit when the disposal price is more than the purchase price of the property. It is chargeable upon profit made from the sale of your land or real property where the resale price is higher than the purchase price. RPGT is charged on chargeable gain from disposal of chargeable asset such as.

Part III Schedule 5 RPGT Act. Real Property Gains Tax RPGT Rates. Real Property Gains Tax.

The RPGT rates as at 201617 are as follows. Imposition Of Penalties And Increases Of Tax. Capital Gains Tax near Linlithgow.

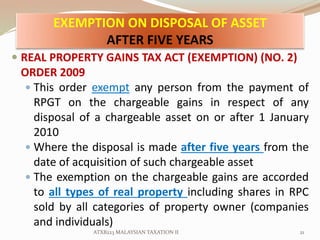

This fact is specified in the Real Property Gains Tax Act 1976 Act 169. RPGTA was introduced on 7111975 to replace the Land Speculation Tax Act 1974. 1 In this Act unless the context otherwise requires-- accountant means an accountant as defined in subsection 153 3 of the Income Tax Act 1967 Act 53.

RGPT was first introduced by the Malaysian Government under the Real Property Gains Tax Act 1976 to curb speculative activities in the property market. An outright gift of an interest in land is completed on the execution of the formal transfer conveyance or assignment of the property or of a declaration. Presented to an immaculate move-in standard throughout the property is close to a wealth of local services and amenities including the train station schools and scenic green spaces.

Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. RM 50000 RM 250000 x 20. On the right you.

Short title and commencement. Relevance Distance Rating Most Reviewed Related searches. It was the first-ever form of capital gains tax and to this day remains the only form of capital gains tax in Malaysia.

Disposal Price And Acquisition Price. 3 - Society registered under the Societies Act 1966 wef 1 January 2022 consists of body of persons registered under any written law in Malaysia 4 - RPGT rates for disposals made in the 6th year and subsequent years reduced to 0 wef. Pegangan Dan Remitan Wang Oleh Pemeroleh Available in Malay Language Only Shares In Real Property Company RPC Procedures For Submission Of Real Porperty Gains Tax Form.

What is Real Property Gains Tax RPGT Malaysia. So if youre a Malaysian citizen and you sell a property after holding it for four years you would be liable to pay RPGT at 20 of the chargeable gain. What most people dont know is that RPGT is also applicable in the procurement and disposal of shares in companies where.

Disposal Date And Acquisition Date. Unannotated Statutes of Malaysia - Principal ActsREAL PROPERTY GAINS TAX ACT 1976 Act 169REAL PROPERTY GAINS TAX ACT 1976 ACT 1692Interpretation. Accountants Tax Returns Payroll Services Vat Returns Bookkeeping Services Business Start Ups Tax Planning.

Based on the Real Property Gains Tax Act 1976 RPGT is a tax on chargeable gains derived from the disposal of property. Set back from the road behind a manicured lawn and a monoblock driveway the front door opens into a welcoming hall with two built-in storage cupboards and a convenient WC. 01506 335041 Local call rate.

1852 - Category B Listed - Generous Accommodation 105sqm - Town. According to the Real Property Gains Tax Act 1976 RPGT is a form of Capital Gains Tax in Malaysia levied by the Inland Revenue LHDN. May slow down the housing market long-term.

This Act may be cited as the Real Property Gains Tax Act 1976 and shall be deemed to have come into force on 7 November 1975. Assessment Of Real Property Gain Tax. - Period 3 Bedroom Top Floor Apartment - Built circa.

Nevertheless it has also gone through several changes over the years. Cancellation Of Disposal Sales Transaction. In Malaysia Real Property Gains Tax RPGT is a tax imposed by the Inland Revenue Board LHDN on chargeable gains which find their source in the disposal of real property.

Capital Gains Tax Linlithgow Capital Gains Tax near Linlithgow. In the above example where your gain was RM250000 the RPGT payable would be RM 50000. It means you have to pay 5 tax on profits of your sale.

Both Acts were introduced to restrict the speculative activity of real estate. Disposer who is not citizen and not permanent resident or an executor of the estate of a deceased person. This Act may be cited as the Real Property Gains Tax Act 1976 and shall be deemed to have come into force on 7 November.

RPGT is imposed as a result of the profits made from the difference between the disposal price. Added on 08032022 by Paul Rolfe Sales and Lettings Linlithgow.

All You Need To Know About Real Property Gains Tax Rpgt

Key Changes In The Real Property Gain Tax Cheng Co Group

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Taxation On Property Gain 2021 In Malaysia

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Real Property Gains Tax Part 1 Acca Global

Taxplanning Rpgt Exemption The Edge Markets

Real Property Gains Tax 101 Malaysian Taxation 101

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gains Tax Valuation And Property Management Department Portal

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Real Property Gains Tax Part 1 Acca Global

Real Property Gains Tax Rpgt In Malaysia Malaysia Property Update

Real Property Gains Tax Its Exemptions Publication By Hhq Law Firm In Kl Malaysia

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

What Is Real Property Gains Tax Rpgt In Malaysia 2021

Procedure For Filing Real Property Gains Tax Form Malaysian Taxation 101

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia